A currency peg or fixed exchange rate is established when a country pegs the value of its currency to another currency or a currency basket. Rather than permitting the market to determine the exchange rate (which is the practice for most of the major currencies), the central bank uses active intervention to keep the exchange value at a predetermined value.

The difference in currency pegged versus floating currency seems to be quite simple. Currencies that float, such as the US dollar, the euro, and the British pound change in value on a constant basis based on supply and demand. A pegged currency will stay within a narrow band of value against its currency peg. Think of a pegged currency like a voucher for candy, you can always exchange that voucher for candy regardless if candy gets scarce or plentiful; you will still receive the same amount of candy when exchanging your voucher.

History and Classic Examples of Currency Pegs

Pegs of currency emerged as countries desired stability in their international trade and investment. After World War II the Bretton Woods system pegged most major currencies to the US dollar, which was convertible to gold; though that system collapsed in 1971, many countries went on to use pegs to anchor their monetary system.

Countries typically establish currency pegs for three main reasons: to stabilize prices and control inflation through monetary discipline established in a country with a stronger economy, to promote trade and investment by removing exchange rate uncertainty and third, to establish credibility for their central banks, particularly in developing economies with histories of monetary instability.

Types of Currency Pegs

urrency pegs are various types, each with unique traits that have implications for central banking operations and trading decisions. By understanding a currency peg, you can help determine the degree of stability and evaluate the predicted behavior of central banks in your trading activities.

A hard peg, often chosen for its rigidity and sometimes called a currency board, requires no alteration to the pegged exchange rate. Central banks that adopt a hard peg guarantee convertibility of domestic currency into foreign currency at a fixed rate and hold foreign reserves equal to or greater than the domestic money supply as a backing. Think of a hard peg's lack of wiggle room as locking in a price.

Macroeconomic Impacts on Pegged Currencies

Macroeconomic aspects place continuous strain on currency pegs, and understanding such forces allows traders to forecast instability and take advantage of opportunities to profit. In this environment, the most influential factor is the interest rate spread between the pegged currency's country and its anchor.

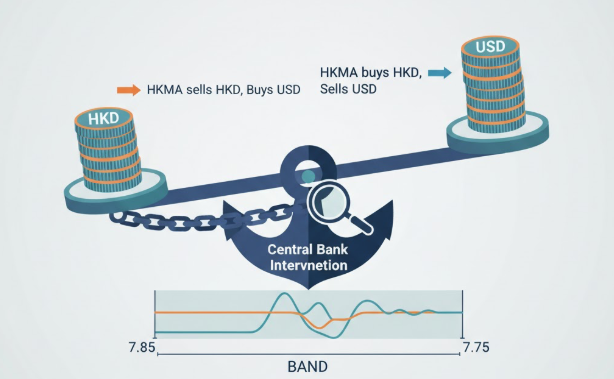

When the central bank of the anchor raises rates and interest rates in the pegged currency's country remain low, capital will flow towards the higher yield. This converts the capital flow patterns into selling pressure on the peg that forces the central bank to intervene. Conversely, if interest rates are higher in the pegged currency's country, the currency will benefit from a natural capital inflow that creates selling pressure that strengthens the peg. For instance, when the Federal Reserve aggressively raised rates in 2022 and 2023, the Hong Kong Monetary Authority was forced to raise rates to maintain the HKD peg, even though the Hong Kong economy might have benefited from falling rates.

Common Misconceptions and FAQ

Truth: No peg is ever truly permanent. Even the most honorable peg incurs ongoing costs and trade offs. The Hong Kong dollar peg has lasted almost 42 years, but the peg still undergoes incredible threat and necessity of management. In the case of pegged currencies, there are always many examples of the peg becoming unpegged. Just ask the countries of Thailand and Argentina about needing some event to justify pegging a currency to the US dollar that is sometimes instant. Just to be safe and honest, if one views the pegged currency as "risk free," one is likely to lose money when reality knocks.

Truth: Pegged currencies do fluctuate within their bands, and can even do so significantly. The USD/HKD trades in a USD 7.75-7.85 range which is more than 1.3% total movement. Since traders often use leverage, this can be a reason to earn substantial profits and/or substantial losses. The days of volatility, even within the bands that the trader is working within, invariably create an opportunity. The peg may constrain the price movements, but does not eliminate them.

For more info:-

forex trading platforms

online trading platform