The Evolution of Finance in the Age of Artificial Intelligence

The financial landscape has always been driven by data, precision, and timing. Over the decades, we’ve seen a steady progression from manual ledger books to sophisticated ERP systems and now to the intelligent era of artificial intelligence (AI). The modern finance professional is no longer confined to spreadsheets and reconciliations but is instead guided by intelligent systems that provide insights, automate repetitive processes, and enhance decision-making. This transformation is powered by AI for Financial Services, a technological leap that’s reshaping how organizations analyze, predict, and execute financial operations.

The finance sector, once hesitant to adopt automation beyond basic accounting tools, now finds itself embracing AI-powered copilots capable of contextual understanding, real-time analytics, and autonomous decision support. These tools don’t replace finance professionals—they empower them to focus on strategy, compliance, and growth rather than mundane tasks.

Understanding the Power of AI Copilot for Finance Workflows

An AI copilot for finance workflows is not just another software integration. It’s an intelligent assistant designed to seamlessly work alongside financial teams, helping them streamline processes and improve efficiency. Imagine an assistant that can automatically process invoices, flag anomalies in transactions, generate forecasts, and even respond to audit queries—all while learning from patterns in your organization’s data.

This AI-driven copilot acts as a digital partner that can handle large-scale, repetitive tasks such as reconciliation, expense management, and report generation, freeing human experts to focus on strategic financial planning and innovation. Beyond automation, it leverages predictive analytics and natural language processing to interpret complex data and provide actionable insights that help leaders make data-driven decisions with confidence.

Why AI for Financial Services Is a Game Changer

The integration of AI for Financial Services goes beyond efficiency—it’s about transformation. Financial institutions and corporate finance departments are leveraging AI to achieve unprecedented levels of accuracy, compliance, and foresight. AI models can analyze vast amounts of structured and unstructured data, uncover hidden patterns, and detect potential risks before they escalate.

Fraud detection, credit scoring, investment analysis, and customer risk assessment are just a few of the areas being revolutionized by AI. Moreover, AI enhances regulatory compliance by continuously monitoring data for anomalies and deviations, ensuring organizations stay aligned with evolving financial regulations.

One of the most remarkable benefits of AI in finance is its predictive capability. Traditional analytics tell you what has happened, but AI can forecast what’s likely to happen. From predicting cash flow fluctuations to identifying market opportunities, AI provides the intelligence necessary for proactive financial management.

The Synergy Between Humans and AI in Financial Operations

The introduction of AI copilot for finance workflows has created a new era of human-AI collaboration. Instead of viewing automation as a threat, finance professionals now recognize it as a strategic partner. AI copilots handle routine, data-heavy tasks, while human experts focus on analysis, creativity, and judgment—areas where human intuition remains unmatched.

For instance, an AI copilot can prepare a financial report, highlighting key metrics and variances, but it’s the finance professional who interprets the results and communicates the story behind the numbers to stakeholders. This synergy ensures accuracy, speed, and insight at every level of financial operations.

AI copilots are also adaptable. As they learn from ongoing workflows, they evolve to better suit an organization’s specific needs. This makes them not just tools, but integral members of modern finance teams—capable of continuously improving performance and decision-making.

Future Trends: The Intelligent Finance Ecosystem

The future of financial services is not about isolated automation; it’s about building a connected ecosystem powered by AI. Cloud-based finance platforms, machine learning models, and real-time data integration are converging to create intelligent, agile, and responsive financial systems.

Organizations that embrace AI for Financial Services are setting new standards for operational excellence. From predictive budgeting and automated compliance tracking to conversational AI for financial insights, the industry is moving toward a future where decisions are faster, smarter, and more transparent.

In the coming years, AI copilots will become more intuitive, offering real-time strategic recommendations, automating complex audit processes, and even optimizing financial strategies dynamically as market conditions change.

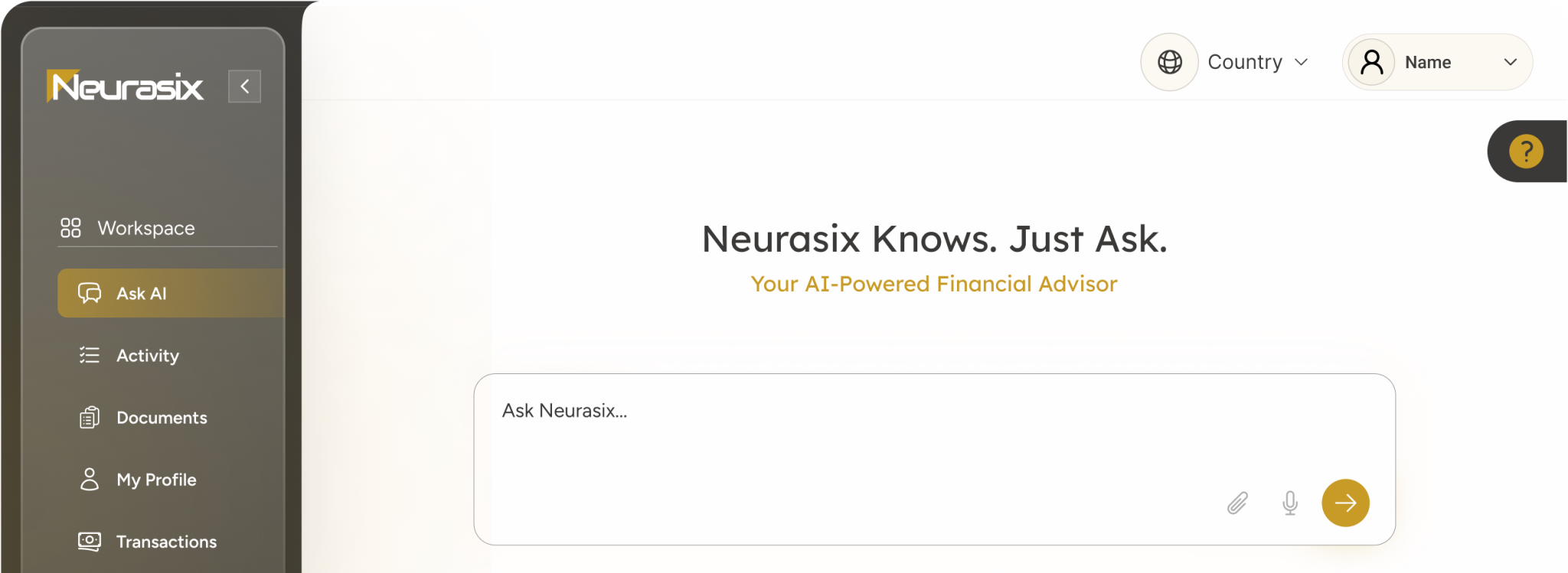

Conclusion: Driving Financial Innovation with Neurasix.ai

As financial organizations continue to navigate an increasingly complex and data-driven world, the integration of artificial intelligence will no longer be optional—it will be essential. Leveraging an AI copilot for finance workflows enables finance teams to operate with greater speed, intelligence, and accuracy, while the adoption of AI for Financial Services ensures they stay ahead of regulatory, operational, and market challenges.

For businesses looking to harness the full power of AI in their financial operations, neurasix.ai stands at the forefront of this transformation—empowering finance teams to innovate, optimize, and lead with intelligence.